In case you missed it, there was a lot of turbulence in the crypto industry in 2022. Amongst the collapses was Three Arrows Capital, a now defunct Singapore-based hedge fund with at one point a reported $18 billion in net asset value. In its glory days 3AC amassed an A+ collection of Digital Art, including rare works by the most sought-after artists in the space. As the collapse and liquidation events played out over the last year, there was a cliffhanger: what happens to the art?

While it’s not a new concept to liquidate an art collection, to liquidate one with no physical properties is a first. Over the coming months Sotheby's will host several offerings via public auction and private sale of the collection. As eager collectors will get a chance to bid for rare blue-chip works, new industry standards will take shape helping to define best practices in this burgeoning field.

- Caroline Taylor, Founder, Appraisal Bureau

A new era for liquidation - what happens to art with no physical properties?

Death, divorce, debt: these three ‘D’s’ are said to have underpinned the sales of art collections across the globe, for centuries. Yet, while the process of the first two are depressingly familiar to many, the process of liquidating an art collection following a bankruptcy, is lesser known. The process of liquidating a digital art collection, even more so.

The principles are simple enough: establish clear lines of ownership, assess the works’ value and sell them. Yet, as with so much in the art world, such simplicity is rarely obtained.

With Sotheby’s announcing its sale of the substantial and significant Digital Art collection (featuring works by Dmitri Cherniak, Tyler Hobbs and Larva Labs) of the now defunct hedge fund, Three Arrows Capital, later this month, understanding how liquidation translates into the digital sphere, is pressing.

Step 1: Establishing Ownership

Who owns the artwork? The ongoing multitude of lawsuits, disputes and headlines devoted to this subject over the years makes it clear that such a straightforward question may belie a plethora of complexity. If fractional ownership is factored in as well, the confusion may be compounded.

Digital advances, and blockchain in particular, offer an unprecedented opportunity for transparency in the ownership structures and records of artworks. 'Ownership' of an NFT boils down to the wallet that has signed for a transaction, which is controlled by a private key - secure storage of the private key is paramount to responsibly owning NFTs.

Step 2: Determining Value

The valuation of physical artwork comes with its own challenges and requires the assessment of experts. The breadth of factors taken into consideration (including the reputation of the maker, provenance and material condition) are met with the current market conditions at the time of appraisal. Appraisals of Digital Art, when in the medium of NFTs, require additional considerations native to crypto assets. Third-party neutral valuations are crucial, with no bias to any party.

Step 3: Selling the works

Along with neutral value, the liquidation process also requires a neutral storage location. While traditional art is moved to a secure vault, Digital Art must be moved to a secure wallet. (Pending what type of storage one chooses for securing the private key - a physical vault may be utilized here too.) A third-party is engaged to sell the assets, with proceeds offsetting debts.

Dmitri Cherniak, Ringers #879 (The Golden Goose)

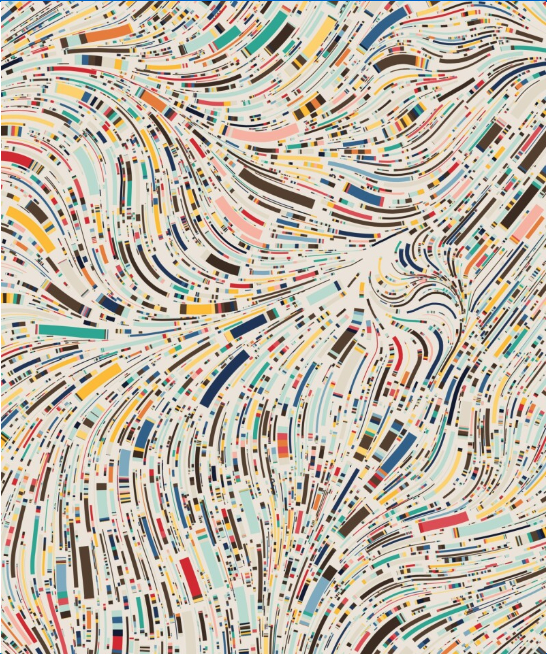

Generative vs. Algorithmic Art

The 3AC collection is encyclopedic in its survey of Generative and Algorithmic Art. But what's the difference? Generative Art traces back in art history over a century with roots in the 1920s Dada movement, and weaves its way up through the earliest forms of 'Computer Art,' and finally the more contemporary New Media Art. Under the umbrella of Generative Art is Algorithmic Art, which specifically relies on predefined rules through the use of algorithms, and possibly AI.